SUSTAINABILITY

Corporate Governance

Fundamental Approach to Corporate Governance

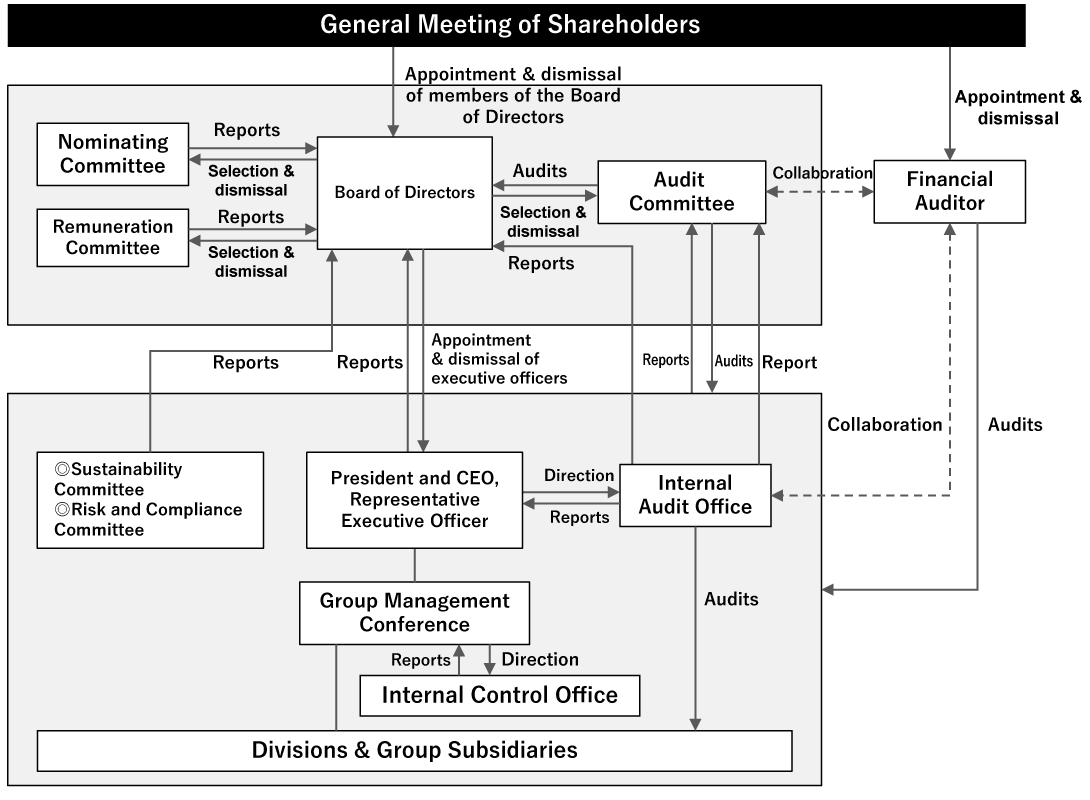

The Company aims to be a corporate entity needed by society in order to fulfill its social responsibility as a good corporate citizen, and strives to build relationships of trust with stakeholders, including shareholders, employees and business partners. The Company is a company with Nominating and other Committees based on the principle of the monitoring model, and it has increased management efficiency by clearly segregating execution and supervision. The Board of Directors collaborated with the Nominating Committee and the Remuneration Committee to strengthen the supervisory function over Executive Officers. In addition, the Company is working to enhance its corporate governance while ensuring sound, efficient and transparent management for sustainable growth and the enhancement of medium- to long-term corporate value.

Corporate Governance System

The Company’s corporate governance system is as indicated in the diagram.

Board of Directors

Composition of the Board of Directors

The Company’s Board of Directors consists of eleven members (of whom six are outside members and three are female members). Alongside determining the Company’s basic management policies, the Board of Directors delegates authority to Executive Officers and supervises the execution of duties by said Executive Officers. The Company appoints independent outside members of the Board of Directors* through comprehensive consideration of each candidate’s character, insight, past experience in important positions, legal expertise, managerial ability at other companies, practical experience, performance, personal connections in the business community and other factors. Regarding diversity, five of eleven members of the Board are independent outside members of the Board of Directors, three are women. Based on the opinions and advice that we received from these independent outside members of the Board of Directors, we plan to enhance the transparency and reliability of the Board of Directors and reinforce management supervisory functions while revitalizing the Board.

For details concerning the composition of the Board of Directors and the backgrounds of members of the Board of Directors, please refer to the Notice of the 8th Annual General Meeting of Shareholders (pp. 4-19).

*Non-executive members of the Board of Directors

Non-executive Chairperson of the Board of Directors

Yuki Kobayashi, Member of the Board of Directors and Founder, serves as the non-executive chairperson of the board.

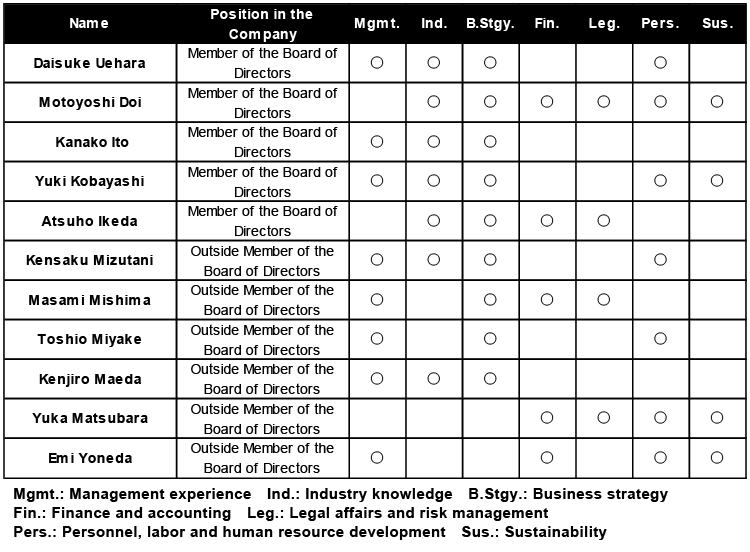

Diversity of the Board of Directors

Candidates for member of the Board of Directors are selected by the Nominating Committee, which is comprised of a majority of outside members of the Board of Directors. Said candidates for members of the Board of Directors are selected in consideration of the Company’s management strategy, medium- to long-term plans and priority issues while comprehensively taking into consideration each individual’s abilities, experience, expertise and other qualities. The Company strives to optimize the Board of Directors as a whole by ensuring that each individual fulfills his/her roles and responsibilities.

For details regarding the professionalism of members of the Board of Directors and their career history as directors of other companies, please refer to the Securities Report for the Fiscal Year Ended December 31, 2024 (pp. 57-60).

A skill matrix of members of the Board of Directors is set forth.

Industry Experience of Members of the Board of Directors

Please refer to the Notice of the 8th Annual General Meeting of Shareholders (pp. 6-19) for information on the industry experience of members of the Board of Directors.

Member of the Board of Directors and Founder Yuki Kobayashi, one of the founders of the Group, has continued to participate in the management of the Company as a Member of the Board of Director, using his industry experience and knowledge to supervise the execution of operations from a more bird's eye view, even after his retirement as Representative Executive Officer.

Masami Mishima has experience of Outside Director (Audit and Supervisory Committee Member) of BENEFIT JAPAN Co., LTD. Benefit Japan provides comprehensive telecommunication services by packaging SIM cards, devices, content, etc. He has in-depth knowledge that is beneficial to our company, which has the telecommunication infrastructure sector as a pillar of its earnings.

Kenjiro Maeda has experience as Senior Managing Director and General Manager of the Sales Division at Inet Support Inc. Inet Support’s main businesses are contact center operation, temporary staffing, and sales promotion, which are similar to our main businesses.

Emi Yoneda has experience as Director and Vice President of Chiyeya Co., Ltd. Chiyeya specializes in human resource development and organizational development, and Yoneda has provided very useful insight for the Company, for which human resource strategy is a key element of management strategy. Yoneda has also served as an outside director of arara inc., which provides cashless services, messaging services, data security services, and other business services closely related to ours and our client companies' businesses.

Term of Members of the Board of Directors

The term of members of the Board of Directors shall be until the end of the final General Meeting of Shareholders in the business year ending within one year after their appointment.

Conflicts of Interest and Related Party Transactions by the Board of Directors

The Company receives prior approval from the Board of Directors for transactions involving conflicts of interest and competing transactions with shareholders substantially controlled by members of the Board of Directors, Executive Officers, or their close relatives, and reports on such transactions thereafter. Furthermore, these transactions are disclosed in securities reports.

Exercise of Voting Rights at the General Meetings of Shareholders

Appointment and dismissal of members of the Board of Directors are determined by resolutions adopted by the shareholders at the general meetings of shareholders.

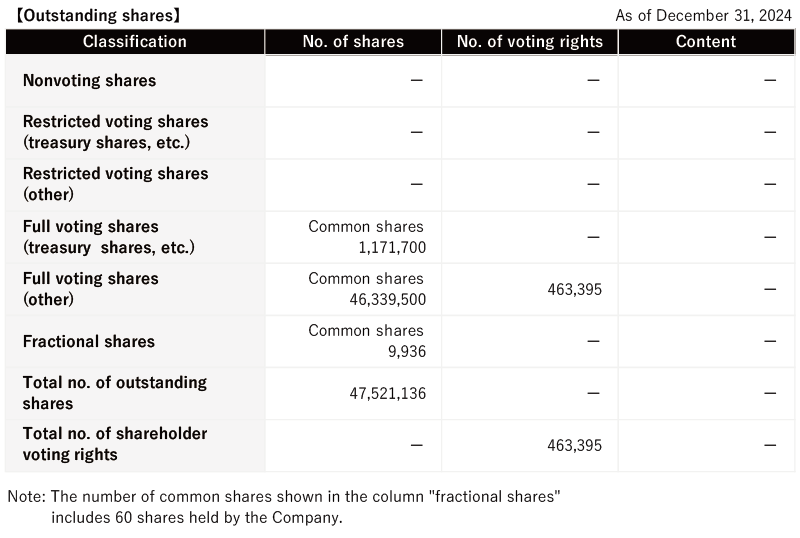

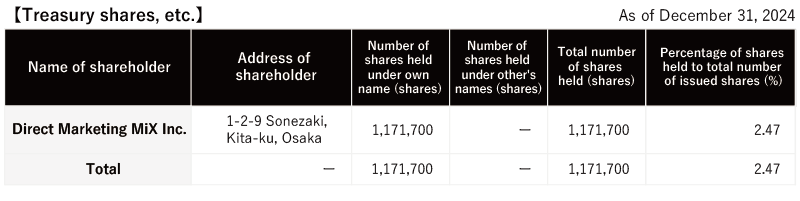

With regard to voting rights, the principle of one share, one vote is applied.

Please refer to the following for the state of voting rights:

For other details, please refer to the Articles of Incorporation (p. 5).

For details regarding the determination of remuneration for members of the Board of Directors, please refer to the Securities Report for the Fiscal Year Ended December 31, 2024 (p. 66).

For information concerning the results of the exercise of voting rights, please refer to the Notice of Resolutions of the 8th Annual General Meeting of Shareholders.

If a shareholder is unable to attend the general meetings of shareholders, the shareholder may exercise voting rights through a proxy. Voting rights may be exercised at the general meetings of shareholders by attending the meeting, by mailing a voting rights exercise form to the Company, or via the Internet.

Provision of Incentives and Remuneration to Members of the Board of Directors and Executive Officers

For information concerning the provision of incentives and remuneration to members of the Board of Directors and Executive Officers, please refer to the Corporate Governance Report (pp. 16-17) and the Notice of the 8th Annual General Meeting of Shareholders (pp. 43-45).

In addition to such financial indicators as sales and profit, we incorporate non-financial indicators including the environment, society, and governance into remuneration systems, creating incentives for the Company’s members of the Board of Directors, including the CEO, to enhance corporate value from a social perspective. Specifically, the degree of achievement of KPIs for job creation & human resource development (formulate and implement career development programs) and for information security (zero incidents of serious personal data loss, 100% information security education implementation rate), the percentage of women on the Board of Directors, the degree of achievement of GHG reduction targets, the percentage of women in managerial positions, and evaluations by external organizations such as FTSE, MSCI, and Sustainalytics. The performance period for variable remuneration and period for vesting of remuneration are one year. 6.9 percent of the remuneration of the President and CEO is stock remuneration.

However, the Company has introduced malus and clawback provisions.

In the event that a serious violation of laws and regulations or misconduct by the subject member of the Board of Directors or Executive Officer is discovered, the Company may demand the reduction or forfeiture of the shares during the restricted transfer period and the return of the shares after the termination of the restrictions on transfer.

This system is stipulated in the restricted share allotment agreement concluded with members of the Board of Directors and Executive Officers.

The Board of Directors Policy on Diversity

We appoint independent outside members of the Board of Directors after giving comprehensive consideration to such factors as character, knowledge, history of appointment to key positions, legal specialization, management skills at other companies, practical experience, performance, and networks within business circles. In addition, our policy is to emphasize diversity, including gender, race, ethnicity, country of origin, nationality, and cultural background, in the board nomination process. Regarding gender diversity, currently 3 of the 11 members of the Board of Directors are female. Our target is to have women account for 30% of the Board by the end of March 2030.

Of the eleven members of the Board of Directors, five are independent outside members of the Board of Directors and based on the opinions and advice that we received from these independent outside members of the Board of Directors, we plan to enhance the transparency and reliability of the Board of Directors and reinforce management supervisory functions while revitalizing the Board.

Policy of Diversity Among the Top of Executive Departments

We believe that supporting diversity and inclusion will lead to the enhancement of our corporate value and that achieving diversity among decision makers is crucial for this purpose. Regarding gender diversity, our goal is to raise the ratio of women in the top of executive departments, as well as in the management positions below them; as of December 31, 2024, the ratio of women in the top of executive departments is 4.8%.

Board of Directors Meetings and Attendance by Members

The Board of Directors met 13 times in 2024.

Information concerning the composition of the Board of Directors,* Board meetings and attendance at meetings is indicated in the table. In principle, members of the Board of Directors are required to have an attendance ratio of more than 75% at the Board of Directors meetings.

- *The composition and position of members of the Board of Directors are as of 2024.

- *Since Kanako Ito was elected at the 7th Annual General Meeting of Shareholders held on March 22, 2024, the total number of meetings of the Board of Directors held differs from that of the other Members of the Board of Directors.

| Name | Position within the Company & Area of Responsibility | Attendance at Board of Directors Meetings |

|---|---|---|

| Daisuke Uehara | Member of the Board of Directors President and CEO, Representative Executive Officer Remuneration Committee Member |

13/13 (100%) |

| Motoyoshi Doi | Member of the Board of Directors Executive Officer and CFO Head of Corporate Strategy Division |

13/13 (100%) |

| Kanako Ito | Member of the Board of Directors Executive Officer |

10/10 (100%) |

| Yuki Kobayashi | Member of the Board of Directors Nominating Committee Member |

13/13 (100%) |

| Atsuho Ikeda | Member of the Board of Directors | 13/13 (100%) |

| Kensaku Mizutani | Outside Member of the Board of Directors Nominating Committee Member |

13/13 (100%) |

| Masami Mishima | Outside Member of the Board of Directors Audit Committee Member |

13/13 (100%) |

| Toshio Miyake | Outside Member of the Board of Directors Audit Committee Member (full-time) |

13/13 (100%) |

| Kenjiro Maeda | Outside Member of the Board of Directors Remuneration Committee Member |

13/13 (100%) |

| Yuka Matsubara | Outside Member of the Board of Directors Audit Committee Memberr |

13/13 (100%) |

| Emi Yoneda | Outside Member of the Board of Directors Nominating Committee Member Remuneration Committee Member |

13/13 (100%) |

Analysis and Evaluation of the Effectiveness of the Board of Directors

The Company conducts a questionnaire once a year to all members of the Board of Directors and implement a self-evaluation by them in order to improve the effectiveness of the Board. In addition, by means of individual interviews with each member of the Board of Directors, we identify matters requiring improvement and other issues, which are analyzed and evaluated in the Board. With regard to evaluation of the Board of Directors, the results show that the Board of Directors is fulfilling its roles and responsibilities, etc., indicating that it is generally functioning properly and that its effectiveness has been ensured.

For the summary of the results of the FY2024 evaluation, please refer to Evaluation of the Effectiveness of the Board of Directors.

Nominating Committee

The Company’s Nominating Committee consists of three members of the Board of Directors (of whom two are outside members). By having outside members of the Board of Directors comprise the majority, the Company has established a structure that ensures the appropriateness of nominations. The matters discussed at Nominating Committee meetings concern decisions on the details of proposals for the selection and dismissal of members of the Board of Directors submitted to the general meetings of shareholders. Further, a full-time executive office has been established to ensure prompt and appropriate committee operations.

The composition of the Nominating Committee's members,* meetings held and attendance at meetings is indicated in the table.

- *The composition and position of members of Nominating Committee are as of 2024.

| Name | Position within the Company & Area of Responsibility | Attendance at Nominating Committee Meetings |

|---|---|---|

| Emi Yoneda | Outside Member of the Board of Directors Nominating Committee Member Remuneration Committee Member |

6/6 (100%) |

| Kensaku Mizutani | Member of the Board of Directors Nominating Committee Member |

6/6 (100%) |

| Yuki Kobayashi | Member of the Board of Directors Nominating Committee Member |

8/8 (100%) |

Audit Committee

The Company’s Audit Committee consists of three independent outside members of the Board of Directors. The Company has appointed members with different areas of expertise as it believes this composition will enable the committee to perform audits from a variety of perspectives. The matters discussed at Audit Committee meetings concern the audit and supervision of the execution of duties by members of the Board of Directors and Executive Officers, and decisions on the details of proposals for the appointment and dismissal of the Financial Auditor submitted to the general meetings of shareholders. Further, the Internal Audit Office serves as the executive office supporting the Audit Committee and ensures prompt and appropriate committee operations.

For the status of the audit, please refer to the Securities Report for the Fiscal Year Ended December 31, 2024 (pp. 63-65).

The composition of the Audit Committee's members,* meetings held and attendance at meetings is indicated in the table.

- *The composition and position of members of Audit Committee are as of 2024.

| Name | Position within the Company & Area of Responsibility | Attendance at Audit Committee Meetings |

|---|---|---|

| Toshio Miyake | Outside Member of the Board of Directors Audit Committee Member (full-time) |

18/18 (100%) |

| Masami Mishima | Outside Member of the Board of Directors Audit Committee Member |

13/13 (100%) |

| Yuka Matsubara | Outside Member of the Board of Directors Audit Committee Member |

18/18 (100%) |

Remuneration Committee

The Company’s Remuneration Committee consists of three members of the Board of Directors (of which two are independent outside members), establishing a structure that evaluates business execution in an equitable manner and ensures the appropriateness of remuneration. The matters discussed at Remuneration Committee meetings concern decisions on the basic policy for remuneration, etc. for members of the Board of Directors and Executive Officers, as well as decisions on individual remuneration amounts and the specific calculation methods thereof. Further, a full-time executive office has been established to ensure prompt and appropriate committee operations.

For information on executive remuneration amounts and the methods of setting those amounts, please refer to the Securities Report for the Fiscal Year Ended December 31, 2024 (p. 66).

The composition of the Remuneration Committee's members,* meetings held and attendance at meetings is indicated in the table.

- *The composition and position of members of Remuneration Committee are as of 2024.

| Name | Position within the Company & Area of Responsibility | Attendance at Remuneration Committee Meetings |

|---|---|---|

| Kenjiro Maeda | Outside Member of the Board of Directors Remuneration Committee Member |

9/10 (90%) |

| Emi Yoneda | Outside Member of the Board of Directors Nominating Committee Member Remuneration Committee Member |

10/10 (100%) |

| Daisuke Uehara | Member of the Board of Directors President and CEO, Representative Executive Officer Remuneration Committee Member |

9/9 (100%) |

Executive Officers

Executive Officers are responsible for making decisions regarding business execution and executing said decisions in accordance with the basic policies established by the Board of Directors.

Other Voluntary Committees

Risk and Compliance Committee

The composition of the Risk and Compliance Committee's members,* meetings held and attendance at meetings is indicated in the table.

- *The composition and position of members of Risk and Compliance Committee are as of 2024.

- *Since Daisuke Uehara was appointed as President and CEO, Representative Executive Officer on July 1, 2024, the total number of meetings of the Risk and Compliance Committee held differs from that of the other committee members.

| Name | Position within the Company & Area of Responsibility | Attendance at Risk and Compliance Committee Meetings |

|---|---|---|

| Daisuke Uehara | Member of the Board of Directors President and CEO, Representative Executive Officer Remuneration Committee Member |

8/8 (100%) |

| Motoyoshi Doi | Member of the Board of Directors Executive Officer and CFO Head of Corporate Strategy Division |

11/12 (92%) |

| Yuki Kobayashi | Member of the Board of Directors Nominating Committee Member |

11/12 (92%) |

| Toshio Miyake | Outside Member of the Board of Directors Committee Member (full-time) |

12/12 (100%) |

| Yoshiaki Tanaka | Executive Officer Head of HR |

11/12 (92%) |

Sustainability Committee

The composition of the Sustainability Committee's members,* meetings held and attendance at meetings is indicated in the table.

- *The composition and position of members of Sustainability Committee are as of 2024.

- *Since Yuki Kobayashi has retired as President and CEO, Representative Executive Officer on July 1, 2024, the total number of meetings of the Sustainability Committee held differs from that of the other committee members.

| Name | Position within the Company & Area of Responsibility | Attendance at Sustainability Committee Meetings |

|---|---|---|

| Daisuke Uehara | Member of the Board of Directors President and CEO, Representative Executive Officer Remuneration Committee Member |

4/4 (100%) |

| Motoyoshi Doi | Member of the Board of Directors Executive Officer and CFO Head of Corporate Strategy Division |

4/4 (100%) |

| Yuki Kobayashi | Member of the Board of Directors Nominating Committee member |

2/2 (100%) |

| Yuka Matsubara | Outside Member of the Board of Directors Audit Committee Member |

4/4 (100%) |

| Emi Yoneda | Outside Member of the Board of Directors Nominating Committee Member Remuneration Committee Member |

4/4 (100%) |

Responses to the Corporate Governance Code

We see contributing to society and continuously enhancing corporate value as top-priority management issues, and we strive to be a corporate group that is trusted by all stakeholders. To this end, we work to achieve management efficiency and believe that increasing management soundness, transparency, and compliance will lead to long-term increases in corporate value and maintain stakeholder confidence.

We have positioned the creation, implementation, and functioning of fair management systems for increasing the soundness and transparency of management as well as prompt decision-making and appropriate business execution as key management issues and are working to enhance corporate governance.

For further details, please refer to the Corporate Governance Report.

Compliance

Compliance Declaration

In our management philosophy, we members of the Direct Marketing MiX Group commit ourselves to contributing to the realization of a more affluent society by utilizing the power of people to the full while endeavoring to boost efficiency through technology. By practicing this management philosophy, we aim to be an enterprise that continues to deliver the highest degree of exhilaration to all people concerned.

As our basic policy based on this management philosophy, to constantly pursue the best possible results and become a peerless partner, we have formulated the DmMiX Group Code of Conduct so that every one of us is deeply aware of the Group’s social responsibility, abides by laws, regulations, in-house rules, and so on in the daily execution of our work, and behaves in accordance with social morals.

Firmly understanding that compliance violations lead to a loss of society’s trust in our Group, as well as compensation for damages and a loss of business, we will practice the DmMiX Group Code of Conduct in our daily work as the ideal approach that all executives and employees of the DmMiX Group should follow.

Standing at the helm of all executives and employees of DmMiX, I declare that by faithfully tackling management that places top priority on compliance through conduct based on a definite moral view, we will be an enterprise that gains the genuine trust of society.

Approach to Compliance

We see compliance as a broad concept that encompasses observation of laws and regulations as well as engaging in good faith and proper conduct that incorporates social norms and ethics. We believe that a lack of awareness regarding compliance on the part of an individual employee poses significant risks to the existence of the company. For this reason, we continuously undertake companywide measures by appropriately identifying risks that may have an impact on the Company’s business including compliance violations and take effective countermeasures. For details, please refer to the Securities Report for the Fiscal Year Ended December 31, 2024 (p. 53).

Compliance Implementation Systems and Frameworks

Risk and Compliance Committee

We established a Risk and Compliance Committee to formulate plans and oversee practice with regard to compliance initiatives overall. For details, please refer to the Securities Report for the Fiscal Year Ended December 31, 2024 (p. 50).

the Risk and Compliance Committee

| Board of Directors | ||||||

|---|---|---|---|---|---|---|

| Reports | ||||||

| Risk and Compliance Committee | ||||||

|

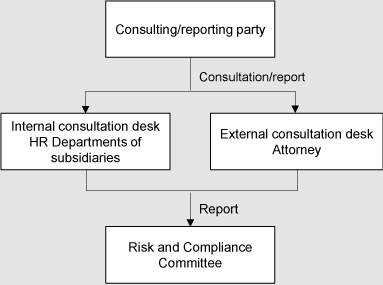

Consultation and Reporting Desks

To prevent violations of laws and regulations, the Company established consultation and reporting desks, posts necessary information on the Company intranet, and takes various other measures to enhance the effectiveness of compliance. We strive to respond promptly and appropriately to internal reports from employees and to prevent unlawful and inappropriate conduct.

If an employee discovers any conduct in violation of or potentially in violation of laws and regulations, the Code of Conduct, or ethics, they can report it through a confidential and anonymous consultation and reporting desks. This reporting system is administered by the Internal Audit Office under the overall responsibility of the Executive in Charge of Compliance. If an employee makes an inquiry by telephone or email, contact is made to the Human Resources Department in the case of the internal desk, and to an attorney in the case of the external desk, and the information is shared with the Risk and Compliance Committee. The Committee investigates the details of the consultation or report and compiles information while protecting the anonymity and confidentiality of the reporting individual and ensuring that the reporting individual is not subject to retaliation. If the Committee determines that disciplinary measures are necessary, the Disciplinary Committee is convened, and the Disciplinary Committee determines the appropriate disciplinary measures.

Furthermore, we have established a system to absorb opinions and feedback from employees using the in-house intranet and make efforts to correct our risk management system and its operation itself, including the whistle-blowing system.

Please refer to Number and Details of Incidents Reported to Consultation Desks for information on the status of the internal reporting system (number of reports, types of misconduct, and measures taken).

Compliance Education for Employees, Including Code of Conduct Observance

Raising understanding and awareness by each employee is essential for thorough compliance, including observance of the Code of Conduct. The Company conducts compliance training for all employees at the time of hiring and asks employees to sign a declaration of their understanding of the code. In addition, based on the Code of Conduct, Risk Management Regulations, and Internal Audit Regulations, the Internal Audit Office regularly conducts e-learning, tests, and other programs for all employees (including full-time, part-time and contract employees) on such topics as compliance and insider trading regulations, thereby raising the awareness of employees. Going forward, we will strive to entrench the observance of our Code of Conduct and compliance in general. Compliance, including the Code of Conduct, is directly reflected in employee evaluations and compensation.

Other Compliance Initiatives

Anti-Bribery and Anti-Corruption

The Company established a policy on the prevention of corruption including bribery, insider trading, and misappropriation of company assets within its Code of Conduct and posted the Code in Japanese and English on the company intranet to thoroughly inform all employees.

We established and operate an internal whistleblowing system to quickly identify circumstances that are or may be corrupt conduct, prevent compliance violations, and quickly rectify any violations that occur. In cases where consultations or reports are made, information is provided to the Risk Compliance Committee, which takes appropriate action. The internal whistleblowing system protects anonymity and confidentiality, and individuals who make reports are not subject to any retaliation.

We also conduct training for all employees that includes content on Anti-Bribery and Anti-Corruption Policy. Through this training, we strive to strengthen understanding of the details of internal regulations on anticorruption, including bribery and other forms of corruptions, transactions that may be suspected of corruption, and consultation and reporting methods so that we can prevent corruption from occurring.

In addition, when commencing new transactions, the Company investigates the reasons for and details of the transaction, the reliability of the trading partner, estimated cost, and other factors and screens potential new trading partners. As part of our ESG risk checks for new business partner, we conduct negative screening for the prevention of corruption as part of our new business partner screening process. We identify risks related to misconduct, such as collusion with public officials, and make a comprehensive decision based on other check items before deciding whether to accept a new business partner.

Supervision on Anti-corruption

The Company established the Internal Audit Office under the direct authority of the President and CEO, Representative Executive Officer as a specialized internal audit organization. The internal audit manager of the Internal Audit Office formulates an annual audit plan in accordance with the Internal Audit Regulations, conduct audits of all divisions and subsidiaries annually regarding the appropriateness of the execution of business and the status of compliance, assessment of risks related to corrupt practices (e.g., risks related to gifts, entertainment, and provision of money or other benefits in order to gain unjust benefits) and report the audit results to the President and CEO, Representative Executive Officer. The President directs audited divisions to make improvements based on the audit results, and by monitoring the status of improvement through the Internal Audit Office, ensures the effectiveness of audits.

Response to High-Risk Transactions and Anti-Corruption Measures

We have established a system to appropriately handle high-risk transactions. The Internal Control Office leads risk assessment meetings attended by relevant parties, including the CEO and members of the Board of Directors. At these meetings, we identify transactions with a high risk of corruption and work to continuously improve our practices by reviewing contract terms and conditions and considering and implementing corrective measures.

Data on Prevention of Bribery and Corruption

- ■Political contributions

- The Company does not make any contributions to political parties or fundraising groups, individual politicians, political organizations, political campaigns, lobbyists or lobbying organizations, trade associations and other tax-exempt groups. The actual amount of political contributions in 2024 was zero yen.

- To date, the Company has not made any contributions to political funding organizations (The People's Political Association), there have been no incidents of bribery or corruption, and the Company has not been subject to investigation by the authorities for corrupt conduct.

- ■Fines, penalties, and settlements relating to corruption

- Legal measures relating to corruption including fines and penalties in 2024 were zero yen. To date, the Company has not been subject to any legal measures.

- ■Number of employee disciplinary measures and terminations relating to anti-corruption policies.

- There were no incidents of employee disciplinary measures or termination resulting from compliance violations in 2024. To date, there have not been any employee disciplinary measures or terminations.

| Reporting areas | Number of breaches in FY2024 |

|---|---|

| Corruption or Bribery | 0 |

| Discrimination or Harassment | 20 |

| Customer Privacy Data | 0 |

| Conflicts of Interest | 0 |

| Money Laundering or Insider trading | 0 |

| Contributions to political parties, individual politicians, political campaigns, lobbying, trade associations and other tax-exempt groups | 0 |

| Fines, penalties, and settlements relating to corruption | 0 |

| Number of employee disciplinary measures and terminations relating to anti-corruption policies | 0 |

Tax Policy

The Company rigorously complies with laws and regulations by establishing and appropriately implementing internal rules in accordance with the Code of Conduct and strives to foster high level of awareness of ethics through internal training and education. With regard to tax matters, the Company complies with tax laws and properly pays taxes by performing tax procedures in accordance with internal rules.

Compliance with Tax Laws

The Company complies with the letter and spirit of the tax laws of countries around the world and international rules and properly pays taxes in all countries where it conducts business activities.

Ensuring Transparency in Tax Matters

The Company provides information to tax authorities in a timely and appropriate manner, works to build trusting relationships through good faith and cooperative responses, and avoids a lack of transparency in tax matters.

Tax Planning

The Company utilizes preferential tax treatment programs and so on to the extent that they are aligned with the Company’s business objectives and strives to enhance corporate value by achieving optimal tax burdens. In addition, the Company does not use business entities with no business purpose or form, transfer profits to low-tax countries, or engage in tax planning or use tax havens with the intention of tax avoidance.

Efforts to Abide by the International Tax Framework

Regarding transactions with overseas parties, we operate appropriately in accordance with the arm’s-length principle so that profits are distributed properly among countries and regions.

Tax Governance

The Board of Directors approves all tax policies, and Executive Officer and CFO has overall responsibility for tax matters within the Group. Under the supervision of the CFO, departments involved in tax-related matters make reports and perform management relating to taxes.

Management of Insider Information

The Company strives to prevent insider trading in order to ensure the fairness and soundness of stock markets and gain the trust of stakeholders. We adopted Insider Trading Management Rules that expressly prohibit securities trading using non-public information obtained in the course of work, require submission of a trading application when trading the Company’s shares, and impose other requirements. We also conduct e-learning on insider trading rules once a year for all employees.

Exclusion of Anti-Social Forces

The Company takes a firm stance against anti-social forces that threaten social order and the safety of civil society, and it shall not have any association with such groups or individuals. In the event that such groups or individuals come into contact with the Company, the Company will immediately respond in a systematic manner and firmly reject any unreasonable or illegal demands in cooperation with the police and related organizations. In addition, in preparation for unforeseen circumstances, the Company acquires information and pays attention to trends related to anti-social forces, and in the unlikely event that it has some form of association with anti-social forces unbeknownst to it, the Company will cooperate with the police and other relevant institutions to promptly terminate the relationship.

Risk Management

Approach to Risk Management

As society and business environments change, the risks that companies face are becoming increasingly complex and varied. We believe that properly identifying risks and effects that could have a material adverse impact on the Company’s business activities and responding in an appropriate and timely manner are critical for achieving sustainable growth as a business enterprise.

Risk Management Implementation Systems and Frameworks

Risk and Compliance Committee

We have established the Risk and Compliance Committee to identify and analyze significant management risks, investigate countermeasures, and prevent risks from materializing. This committee regularly implements risk evaluation relating to such items as fair trade, compliance including corruption and business ethics, human capital, occupational health and safety, accounting and finance, information security, and the environment, identifies significant risks that could exert an impact on our business, and adopts countermeasures as a Group.

Risk oversight at board level is carried out by Toshio Miyake, independent outside members of the Board of Directors and chairperson of the Audit Committee. Furthermore, the Company's risk management system is based on the concept of ‘The Three Lines of Defense’. On the first line, MD (Managing Director) and SMD (Senior Managing Director), who are the heads of each business unit, take Operational Risk Ownership and manage risks. On the second line, the Internal Control Office, headed by Executive Officer Yoshiaki Tanaka, is responsible for overseeing risk management and compliance, and ensures that the relevant departments receive timely and accurate advice and guidance from attorneys and other advisors. On the third line, the Internal Audit Office provides independent assurance on the effectiveness of risk management and compliance processes.

the Risk and Compliance Committee

| Board of Directors | ||||||

|---|---|---|---|---|---|---|

| Reports | ||||||

| Risk and Compliance Committee | ||||||

|

Risk Management Process

Risk Review

Key risk areas that we have identified are: strategic risk, financial risk, compliance risk, operational risk, hazard risk, information security risk, and service provision risk as key risk areas. The Risk and Compliance Committee examines these issues. Additionally, the Group Management Conference manages and makes decisions about the strategic and financial risks that have the most influence on management, while also taking each project's expectations and uncertainties into consideration (risk appetite determination). For each risk, we have defined more detailed risks, identified the occurrence frequency (likelihood) and impact (expected damage) for each of them, designated the responsible department, and taken mitigation measures.

Risk Examples:

| Area | Occurrence frequency | Impact | Mitigating Actions |

|---|---|---|---|

| [Strategic risk] Significant fluctuations in telemarketing market conditions | Low | High | Quarterly review by the Group Management Conference |

| [Hazard Risk] Infection of employees due to outbreaks of new infectious diseases, etc. | Low | Medium | Distribute masks, recommend alcohol disinfection, and install air purifiers |

Financial Risk Management

Financial Risk Management Purpose and Policy

Regarding our Group’s fund operations, our policy is to ensure the security of principal and the efficient utilization of funds in due consideration of various risks, such as credit risk, market risk, and liquidity risk. Furthermore, regarding fund procurement, our policy is to select the most appropriate means of procurement from among those available, such as direct finance and indirect finance, in consideration of the economic environment and other factors at the time.

Market Risk

(a) Outline of market risk relating to financial products

Our Group’s activities are exposed mainly to the risk of fluctuations in the economic and financial market environment. Specifically, the risk of fluctuations in the financial market environment means the risk of exchange rate, interest rate, and price fluctuations. In our Group, the main financial liabilities are borrowings from financial institutions, of which borrowings with variable interest rates are exposed to interest rate risk.

(b) Management system for market risk relating to financial products

Borrowings are made to cover operating funds (mainly short-term) and funds for company reorganization (long-term). For both short-term borrowings and long-term borrowings, we endeavor to reduce the risk of interest rate fluctuations by reviewing borrowing conditions as necessary.

(c) Exposure to interest rate fluctuation risks

Since our Group’s main borrowings have variable interest rates, they are exposed to the risk of market interest rate fluctuations. We constantly monitor market interest rate trends and estimate the profit-loss impact. If the interest rates on variable interest rate borrowings possessed on the final day of the term have risen to more than 1%, the impact on profit before tax is as follows:

| Previous consolidated accounting year (January 1 – December 31, 2023) | Current consolidated accounting year (January 1 – December 31, 2024) | |

|---|---|---|

| Impact on profit before tax (Thousand yen) | (50,684) | (44,026) |

Risk Review and Audit

We conduct a periodic review of our risk exposures at least once a year.

We also conduct internal audits of risks twice year and external audits of information security risks twice each year. Both internal and external audits are conducted in accordance with various internal regulations, employment regulations, ISO27001 and ISO15001.

Risk Management Education

We provide regular training opportunities for non-executive directors on the Company's risk management.

Responses When Incidents Occur

For information concerning responses when incidents occur, please refer to the Securities Report for the Fiscal Year Ended December 31, 2024 (p. 54).

Emerging Risks

Two important long-term (next 3 to 5 years) emerging risks that could have a material impact on our business include the following:

| Name of the emerging risk | Description | Impact | Mitigating Actions |

|---|---|---|---|

| Risk of earthquakes and other natural disasters | Japan, where we do business, is prone to earthquakes, and typhoons and flood disasters have been increasing in recent years. Increasingly likely to occur, unpredictable natural disasters are an important risk from a BCP perspective. | In our labor-intensive business, there is a risk that we may be physically unable to continue our business due to the collapse of buildings or dysfunction of infrastructure caused by natural disasters. | We are working to mitigate risk by spreading our bases across multiple locations, mainly in major cities in Japan. |

| Pandemic Risk of New Infectious Diseases | The risk of epidemics of new infectious diseases is an emerging risk that is growing rapidly in this era of easy mobility and due to the recent decline in biodiversity, and is an important risk for the Company as a contact center business with a large number of employees working at a single location. | In the Company's contact center business, where a large number of employees work at a single location, there is a risk that the spread of an epidemic could result in the absence of a large number of employees and a consequent risk of business continuity. | Air purifiers and partitions separating seats from each other are installed at each location. Masks are stockpiled and distributed within the company. |

Risk Culture

For executive officers of business divisions, the risk of business survival, administrative penalties for violation of laws and regulations, and suspension of business operations for breach of contract are used as indicators, and the results are directly reflected in performance-linked remuneration.

In addition, an effective risk culture is fostered through a system on the company intranet where employees read warnings about information management risks each time they arrive at and leave work and clock in and clock out after indicating their understanding of the risks.

Supply Chain Management

Business Partner Code of Contact

The Company has established The DmMiX Group Basic Policy on Sustainable Procurement to build sustainable and co-creative relations leading to enhancement of the value of all parties concerned based on relations of trust with business partners* and long-term cooperative ties.

In addition, the Company has established DmMiX Group Business Partner Code of Conduct for all companies engaged in business with DmMiX and their employees, subcontractors, agencies, suppliers, vendors, and all other businesses outsourced by these companies, both domestic and international, in order to realize a sustainable supply chain in cooperation with business partners.

- *“Business partners” refer to all companies engaged in business with DmMiX and their employees, subcontractors, agencies, suppliers, vendors, and all other businesses outsourced by these companies, both domestic and international.

Supplier ESG Programs

We identify, assess, and plan corrective measures in relation to the sustainability of our supply chains (supplier ESG program).

Supplier ESG programs are led by the Sustainability Committee. The Committee will provide reports to the Board of Directors on the subject matter of its investigations and discussions, and the Board of Directors will periodically monitor this process and provide direction as necessary.

If it is found that a business partner is acting in contravention of the DmMiX Group Business Partner Code of Conduct, we will request improvements. If improvements are not made, and a striking violation continues, we review the business transaction.

Supplier Screening of ESG Risks

We screen suppliers for transactions, examining the reasons for and details of the transaction, the reliability of the supplier company, and the estimated cost. This screening plays an important role in the Company's risk management.

We have added negative screening items from ESG aspects in our supplier screening since November 2021. We check for problems from an ESG perspectives, including environmental perspectives such as soil and water contamination and pollution, social perspectives such as occupational health and safety (e.g., occurrence of occupational accidents), harms to health caused by products, forced repatriation of foreign workers, encouragement and coercion of illegal employment, nonpayment of wages and overtime, child labor, forced labor and human trafficking, and governance perspectives such as anti-corruption (e.g., collusion with public officials). The results of the screening are used to determine whether any ESG risks have been expressed.

These checks are not limited to suppliers; we also conduct them on client companies to which we assign employees, reviewing their labor practices for any issues.

In particular, as human resources are the capital of our business, we recognize that social issues related to human resources are sector- and commodity-specific risks and take them into deep consideration.

We also screen risks related to the political, social, economic, environmental, and regulatory situations specific to Japan in light of the latest information available, even though the Company only do business in Japan.

If ESG risks are identified as a result of the screening, we make a comprehensive judgment based on a combination of other checkpoints, including business relevance, before making a decision on whether or not to conduct business with the supplier.

Internal Controls

Matters related to Audit Committee

Other systems to ensure audits by the Audit Committee are conducted effectively

Matters related to Executive Officers

Regulations and other systems related to managing risk of loss

System to ensure efficient execution of duties by Executive Officers

Operational status of systems to ensure appropriate business operations

For details, please refer to the Corporate Governance Report (p. 22).

Systems for ensuring the reliability of internal controls concerning financial reporting

President and CEO, Representative Executive Officer Daisuke Uehara and Executive Officer and CFO Motoyoshi Doi are responsible for the establishment and operation of internal controls relating to financial reporting by the Company. We establish and operate internal controls over financial reporting in accordance with the basic framework for internal controls set forth in the “Revisions of Standards for Evaluation and Audit of Internal Controls Regarding Financial Reporting and Practice Standards for Evaluation and Audit of Internal Controls regarding Financial Reporting (Opinion)” released by the Business Accounting Council.

Internal controls are intended to achieve their objectives to a reasonable degree by organically linking the basic elements of internal controls and functioning in an integrated manner. Accordingly, internal controls regarding financial reporting may not completely prevent or detect misstatements in financial reports.

Information Security

Approach to Information Security

For information concerning our approach to information security, please refer to the Code of Conduct, section 5: Thorough Information Security.

Information Security Implementation Systems and Frameworks

The Company has established the Information Management Committee, chaired by Daisuke Uehara, the Member of the Board of Directors, President and CISO, Representative Executive Officer, and created Compliance Department as a specialized department. The Information Management Committee performs maintenance and improvement of information security by redeveloping security-related policies and guidelines, upgrading internal education, and strengthening monitoring to ensure the protection and appropriate use of information assets.

Matters investigated and deliberated on by the Committee are reported to the Board of Directors, and the Board regularly supervises this process and issues instructions as necessary.

The Information Management Committee periodically checks on the operational status of ISMS and through repeated planning, implementation, inspection, and review, seeks to ensure compliance with regulations and rules and pursue spiral implementation.

the Information Management Committee

| Board of Directors | |||

|---|---|---|---|

| Reports | |||

| Information Management Committee | |||

|

Approach to Information Management

Much of the information on the possession of the Company’s subsidiaries is important information such as the personal information of customers. We believe that protecting this key information from various risks, such as alteration and leaks, is crucial for gaining the trust of stakeholders and developing business.

Security Incident Prevention, Detection, and Responses

The Company established the Compliance Department to prevent security incidents* before they occur, detect incidents that do occur as early as possible, quickly bring the situation under control, and minimize any damage.

- *Events that pose a security threat such as infection by malware, unauthorized access, and leaks of confidential information

Measures to Prepare for Security Risks

Accounts used by employees are managed with a user management system that is linked to personnel information, and use of company systems and access to the company intranet by persons without access rights are restricted. In addition, security cards are used to manage access at all sites and information management is reinforced by restricting access, installing security cameras, and taking other measures. We also perform appropriate access control and management of information assets including personal information and confidential data through means such as data encryption, identity verification, device control, and log acquisition and take countermeasures against the risks of information leaks. These measures are implemented by the Information Systems Department under the management of the Information Management Committee.

Security Incident Escalation Process

The escalation process when an employee notices something suspicious relating to information security includes an emergency contact network dedicated to information security with the participation of all employees on the supervisor level and above and a whistle-blowing system. For details on the whistle-blowing system, please see Establishment of Consultation and Reporting Desks.

There were no information security/cybersecurity breaches in 2024.

Security Incident Response Process

To minimize the damage in the event that a security incident occurs, we have established response procedures for the entire Group including subsidiaries. If an incident occurs, employees can access the emergency contact network using a chat function, and the Information Systems Department rapidly implements responses from confirmation of the situation to recovery. Following recovery, the Information Management Committee and Information Systems Department work together to investigate and confirm the cause of the incident and examine countermeasures to prevent reoccurrence.

Specific Measures

- ■Establishment and Announcement of Privacy Policy

- This policy, which is posted on our website, clearly states the purposes of using personal information, contact for inquiries, security management measures, etc.

- ■Establishment of Personal Information Protection Regulations

- We have established the Personal Information Protection Regulations and communicated them to all employees via our in-house intranet. In these regulations, we stipulate basic matters relating to the appropriate handling, administration, operation, and protection of personal information possessed by our Group. We thereby endeavor to facilitate the appropriate and smooth management of work and to protect the rights relating to personal information of data subjects and third parties. If an employee has violated the Personal Information Protection Regulations, he/she may be subject to disciplinary action.

- ■Employee Education and Training on Information Security

- The Basic Policy on Information Security and the Information Security Regulations are posted on the company intranet for all employees to view, and they apply to all employees. The Information Security Regulations stipulate that any violation of information security regulations or laws and regulations will be subject to penalties.

We also conduct information security/cybersecurity awareness training for all employees (including full-time, part-time, and contract employees) by means of e-learning every six months, and the post-training test is repeated until everyone scores at least 80 points. The training informs employees about the importance of information security and heightens crisis awareness regarding the Personal Information Protection Act while supporting acquisition of knowledge necessary for business operations. - ■Acquisition of Information Security Certification

- The Company is a holding company, and we recognize that information security is a high risk for our subsidiaries. Accordingly, each subsidiary has acquired ISO27001 certification, an international standard for information security management systems (ISMS), and Privacy Mark certification, a third-party certification system for personal information protection systems. Each certification conducts an external audit once a year respectively. In this way, we ensure thorough information management and continuous improvement.

The status of ISO27001 certification and Privacy Mark acquisition is as follows:

ISO27001

The following call centers are ISO 27001 certified out of 12 total business locations.*

-

・CRTM Umeshin First Center

・CRTM KDX Higashi-Umeda Center

・CRTM JRE Umeda Square Center

・CRTM Sapporo AN Center

・CRTM Shinjuku Mitsui Center

・CRTM Sanbancho Shinwa Center

・MR Kintetsu Shin-Nanba Center

・DRM KDX Higashi-Umeda Center

・DRM JRWD Umeshin Center

・DRM Sapporo AN Center

Privacy Mark

Of the Direct Marketing MiX, Inc. and its seven subsidiaries, the following five companies, which are business entities, have acquired the Privacy Mark.*

-

・Customer Relation Telemarketing Co., Ltd.

・Marketing-Revolution Co., Ltd.

・Data Relation marketing Co., Ltd.

・STAFF FIRST Inc.

・Architect Co., Ltd.

DX Promotion

DX Strategy

(1) Promoting DX for Client Companies and throughout Society

Leveraging our accumulated sales and marketing strengths, as a DX Enabler, we are promoting the digitalization of conventional face-to-face services and social implementation of new digital services.

Examples: Online helpers for mobile phone shops

Social implementation of food delivery services

Online medical receptionist services, etc.

(2) Improving Productivity and Efficiency through DX

We are improving business productivity and efficiency by utilizing RPA, AI, and BI tools in some processes within our own marketing and BPO.

Examples: Enhancement of sales performance using AI

Visualization of operating results at sales sites using BI tools

Automation of business operation using RPA

Construction of IPPBX using an in-house private cloud

(3) Development of Environment for DX utilization

To promote even greater use of DX, we are working to improve use environments including optimization of facilities such as our own offices and establishment of work from home systems.

Examples: Optimization of facilities such as offices and centers

Establishment of telework systems using IT

Shifting CTI systems to the cloud and using digital technologies in call center operations

Introduction of solutions using data

DX Promotion System

The Corporate Strategy Division and Administration Division are formulating strategies and policies for promoting DX within the Company. In promoting specific initiatives, the System Department is positioned as the operation and management division, which works to resolve DX issues through discussions with related divisions, and ultimately expands to the entire group, including subsidiaries, to promote DX in cooperation throughout the company.

In order for the entire group to achieve further business growth, it is essential to realize a DX strategy that both provides value to client companies and society as a whole and improves productivity and efficiency in the company's own operations. We believe that it is important to develop and secure highly specialized human resources who can respond to new digital services and utilize RPA, AI, and BI tools. We are committed to developing and securing human resources for DX promotion, even as we expand our corporate scale in line with future business growth.